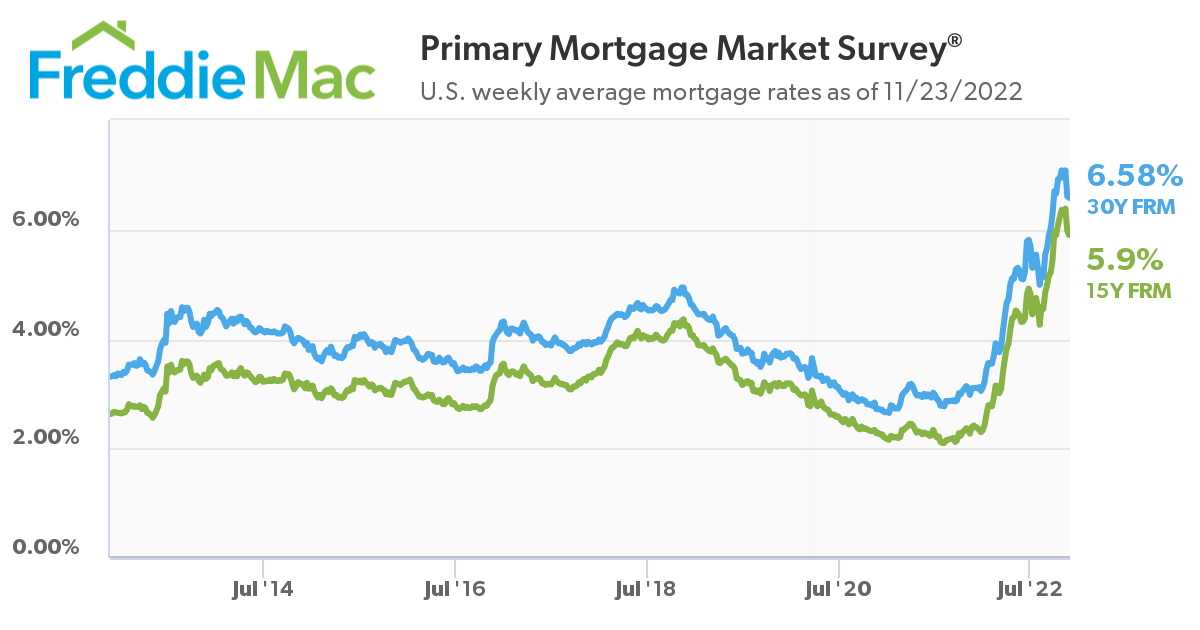

Mortgage interest rates fell in November and have hovered around 6.5% for several weeks now. The rate volatility we experienced during the fall has subsided for now, and recent housing data suggests we may be close to finding a bottom for the floundering housing market, which went into shock this spring when rates rose from all-time lows.

Here’s a quick look at some of the key data lines from the October home sales data:

The median home price in King County ($903,250) rose 2.6% compared to September and remains 9.3% higher than September 2021, bucking the 4-month downward trend since prices peaked in May (at $1,000,000!).

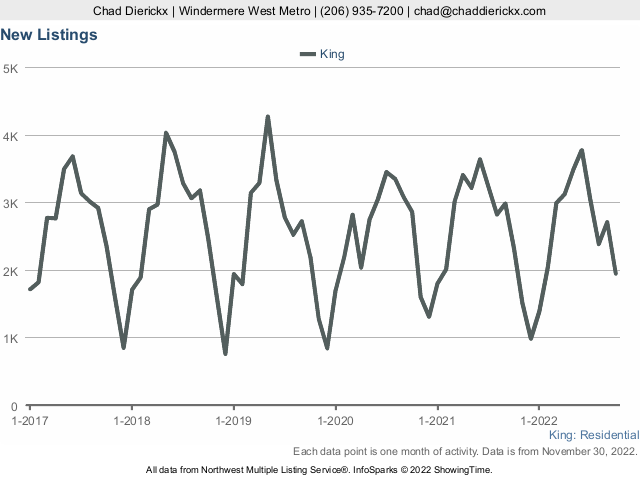

New listings dropped 28.1% MoM and were down 16.1% YoY.

Pending sales, an early measure of demand, fell 3.2% from September and 39.2% YoY.

Homes took just 13 days to sell, down 18.8% MoM, but more than double last year’s median days on market (6). Homes are still selling remarkably fast from a historical perspective.

*NWMLS sales data for single-family homes in King County

Backing away to see how our market compares to other markets across the US, here's a fascinating graphic from Black Knight showing the change in median price from peak earlier this year.

Like other markets that experienced dramatic price gains during the pandemic, we're seeing some of the gains erased just as fast as they appeared!

The other real estate news this week was that the Federal Housing Finance Agency announced new conforming loan limits for 2023—$726,200 for most areas (up from $647,200 in 2022) and $977,500 for King County. This change reflects higher prices across most markets across the US.

And earlier today, Jerome Powell suggested that rate hikes may begin to taper as early as next month. This was welcome news for markets, which rose after the announcement. Remember that mortgage rates are not directly tied to the overnight rate set by the Federal Reserve.

While news remains mixed around housing and the greater economy, the housing market isn't set to fall through the floor as it did in the Great Financial Crisis, and decelerating downward trendlines are an encouraging sign for the industry.