The fall slowdown is here

Halloween decor and wind storms are a clear sign that the 2021 home-selling season is coming to a close. Expect to see fewer listings each week now until the new year.

Nevertheless, competition remains fierce for homebuyers in Seattle. Our recent West Seattle listing attracted 15 offers and a big price escalation. Buyers are out there in force and I expect 2022 to see the same pent-up demand we've been seeing for years. This will result in higher home prices next year, even if interest rates rise slightly (more on rates below).

Huge gains on the Eastside

Now that we're most of the way through 2021, it's a great time to take a closer look at our local real estate market. We'll do more of this in the months ahead, but for now, I want to take a look at how our local market illustrates an important pandemic trend.

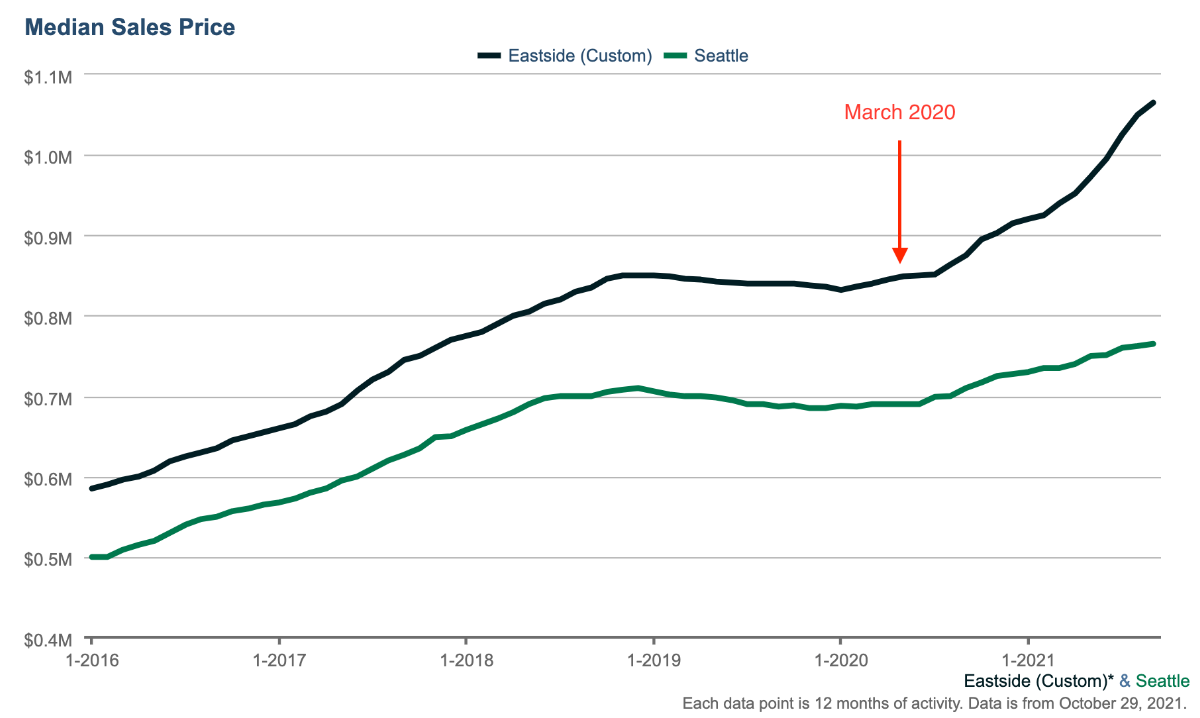

There's been a lot of press coverage about the urban exodus during the pandemic, but now that we're a year and a half into it, the numbers are proving it out. Zoom towns have taken workers away from the city to places like Boseman, MT, and Truckee, CA. But locally, the performance of the Seattle and Eastside markets paints a clear picture of shifting priorities during lockdown.

Here's a look at the median price and inventory levels in Seattle versus the Eastside over the past 3 years. In September, the median price in Seattle was up just 2% compared to the same month last year, while Eastside prices rose 22%. Amazon's move to the east is no doubt responsible for a big portion of this migration, but the pandemic really pushed it into high gear and other companies have followed suit.

Both the Eastside and the Westside saw lackluster inventory levels, even during peak selling season (Q2), but the Eastside had fewer homes for sale than any period on record.

Low inventory levels and low interest rates have pushed prices up for years. In September, the Eastside saw 55% fewer homes for sale than the same period in 2020. In Seattle, there were 38.5% fewer homes for sale.

Pending sales, the most timely indicator of demand, suggests we may be starting to see a reversal of this pandemic preference for the suburbs. Last month, Eastside pending sales were down 17% YoY while Seattle pending sales rose 3%. This could be a result of families sending their kids back to school and shifting their focus away from the home search to things like--oh, I don't know--buying a dozen new masks for your 5-year-old because she loses one every day!

Our region has continued to perform as well as almost any other part of the country, but seeing these two sub-markets diverge has been sobering for Seattleites. I'm bullish for an urban rebound as the world returns to its next "normal," and I believe the quality of life will make Seattle a great place to own property for decades to come.

Mortgage rates rising slowly

Mortgage interest rates are slowly increasing, but they're still near record lows. As rates increase, experts believe purchase demand will remain strong, while refinance activity slows. Windermere's Chief Economist recently did a great video explaining what drives interest rates.

Thanks for reading!