The market slows heading into Q4

Real estate data shows signs of a normal market slowdown heading into the end of the year. We can expect to see new listings drop and market times increase over the next several months. Buyers often wonder if winter is the best time to buy, and for some, it might be. But don't expect your dream home to be easy pickins...even in today's market. In any market, the best homes sell quickly.

The real estate market over the past 15 months has been concerning to some. We spent years watching our homes appreciate at unsustainable rates. Now that the market has dropped (nearly 8% from May 2018), Seattle newcomers seem more inclined to sit on the sidelines. But folks with a long-term plan to stay in their homes should take a long-term view. And frankly, anyone buying real estate should take a long-term view. Homes are illiquid, and selling costs make it very difficult to make a quick buck on real estate.

For those of you worried about a looming recession, keep this historical perspective in mind: "The Great Recession is a major outlier in the relationship between home prices and recessions largely because the overinflated housing market was its major cause. But the housing market, which remains strong, is unlikely to be a culprit or victim of the next recession." (https://www.redfin.com/blog/next-recession-housing-market)

Have you considered refinancing?

Rates for 30-year loans today are lower than a 10-year ARM was at this time last year. If your rate is over 4%, and you plan to stay in your home for the foreseeable future, call a lender and lock in a low rate while you can. You might be tempted to wait, but the elusive "bottom" is usually gone before we recognize it. Don't let perfect be the enemy of the good! Talk to your lender to see if you can save money in the mid/long -term by refinancing your mortgage, especially if you are paying PMI.

What we're reading

Here are a few other interesting reads you may have missed:

Market data

Prices started dropping in May 2018. Note the recovery during Q2 '19, the traditional home-buying season. Sellers, take note if you're planning to sell your home next year.

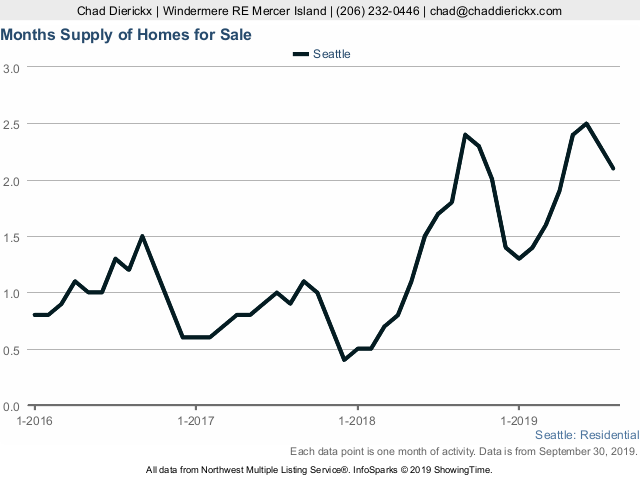

Months supply tells us how long it would take to sell the homes currently listed if homes continue to sell at the same pace at which that they are currently selling. During the hottest markets, we saw less than one month's worth of inventory. 4 months of inventory is considered a balanced market, and more than 5 months is considered a buyer's market.

The last time we saw 4 months of inventory was November 2011. The month I become a real estate agent (in 2009), there were 6 months of inventory!

At this time last year, we started seeing market times tick up until the end of Q1. Like last year, listings are sitting on the market longer, and we can expect this number to continue to grow through the end of 2019.

Thanks for reading!

Best,

Chad