The housing market story of the 2020s (so far)

The frenzied housing market of the early 2020s was one of the most interesting economic stories of the time. For folks who refinanced in the pandemic years at 2.5% or 3%, it was a story that will be proudly retold to future generations.

I recall sitting around with friends comparing mortgage rates, wondering who had timed it best.

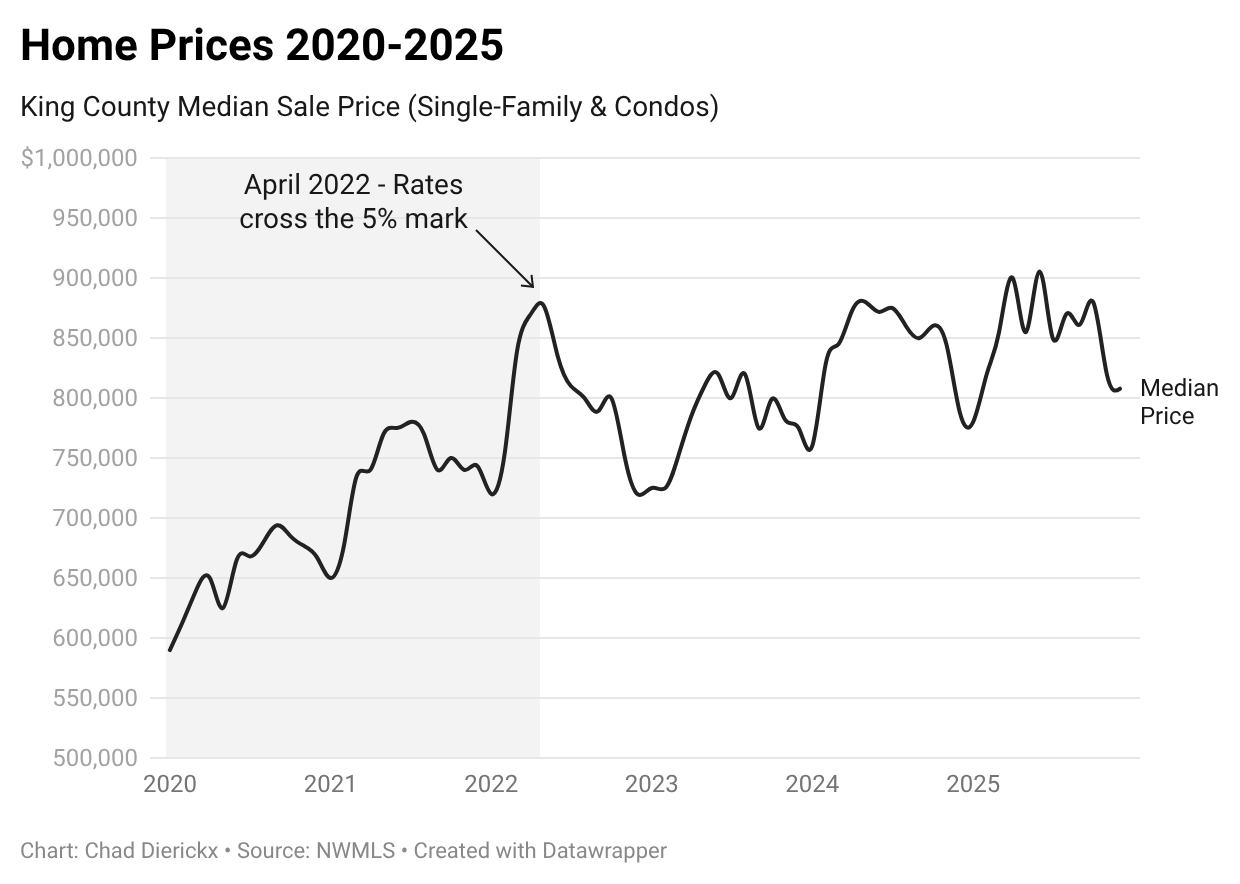

Cheap money and low inventory created chaos in the housing market. Homes sold in hours for 20% above list price. Twenty-five offers after the first weekend. Prices rising 10%+ annually.

At that time, the housing market was fueled by historically low rates, a pandemic that made our homes feel more important than ever, and a remote-work-driven relocation wave that meant many employers didn’t care where you lived as long as you got your work done and turned on the camera during Zooms.

In our region, the tech boom meant endless job security for a large portion of the population and stock market valuations that minted new millionaires every month.

I remember asking Windermere’s Chief Economist at that time, “What will be the force that stops this?” His answer: “I don’t know.”

The unbridled demand of that time hit a supply wall. Builders were still digging out from under a decade of underbuilding following the GFC, and pandemic-era supply chain delays made every new appliance and bundle of lumber cost more, and take longer to arrive. The resulting hike in prices touched every industry.

We now know that inflation would be that force.

After years of near-zero rates, the Fed raised rates aggressively for a year and a half, eventually stopping at 5.5%. The housing market reacted, slowly, as it tried to regain its footing.

But while those run-up years were defined by frenzy and froth, the recovery years feel remarkably steady. Housing is not like a stock—people don’t panic-sell their real estate.

Housing is shelter. We all have to live somewhere.

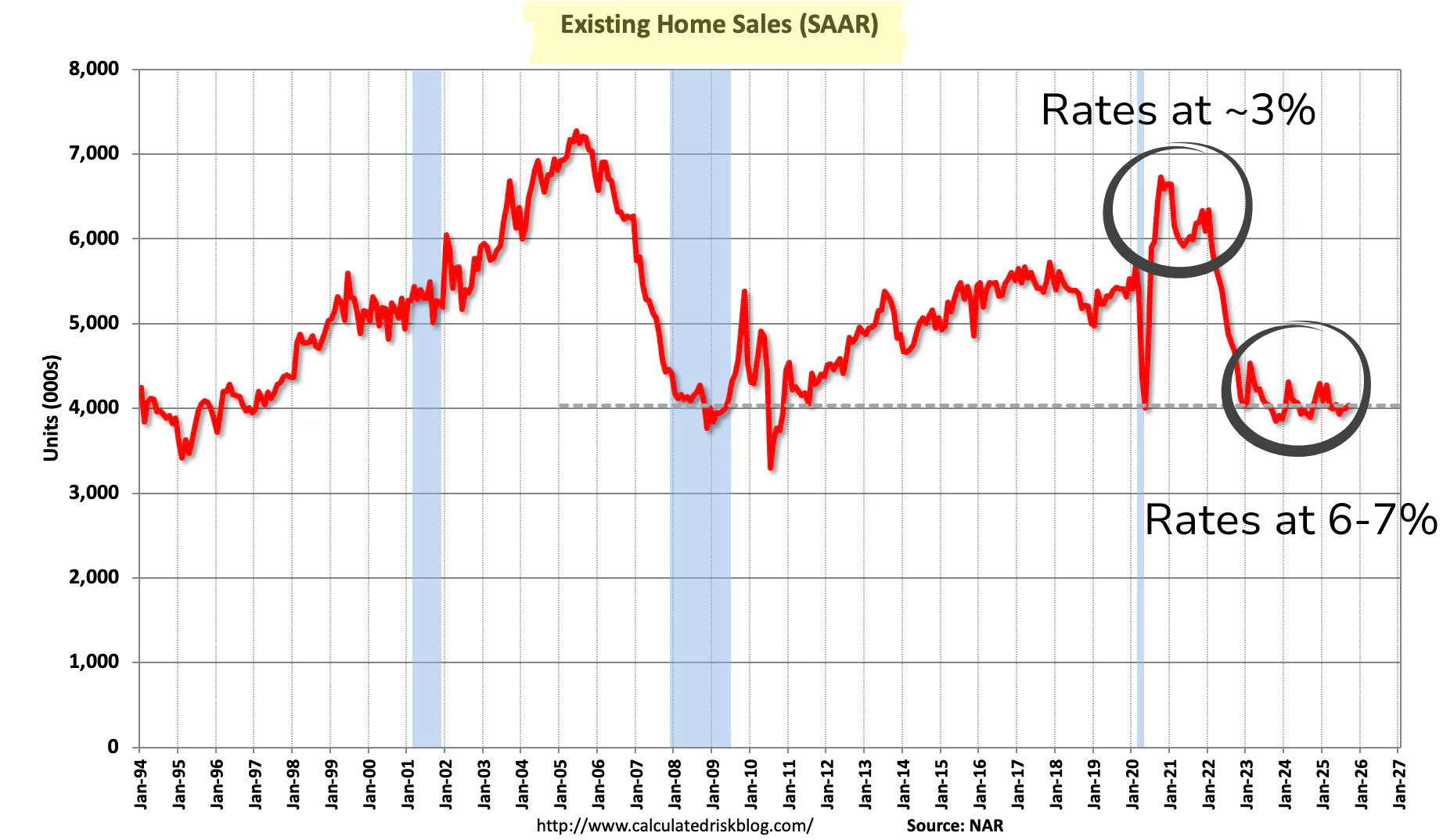

This reality kept a floor under home values after rates more than doubled, leading to a frozen housing market that saw annual home sales go from over 6 million in 2021 to around 4 million in 2023.

2025 marked a turning point

The latest NWMLS year-end data paints a picture of a housing market that’s softer, but far more balanced than in those wacky years;

In King County, inventory climbed 41% compared to 2024

Home prices stalled, increasing just 1% year-over-year

Homes sold close to list price—roughly 99.5%—but took nearly twice as long to sell (~13 days)

Mortgage rates started 2025 near 7% and ended the year around 6%

Three weeks into 2026, you can feel the freeze thawing. The first quarter of this year looks like it may turn in favor of sellers across Seattle, Mercer Island, and the Eastside.

I’m encouraging sellers to get to market quickly, and advising buyers to get pre-underwritten so they’re ready if competition returns.

It’s been nearly four years since rates first passed 5%. There’s real pent-up demand from people who have spent that time postponing an inevitable move.

If your time has come—or you’re just starting to think about it—contact me and let’s talk about how to help you get where you’re going.