Seattle housing is loosening up

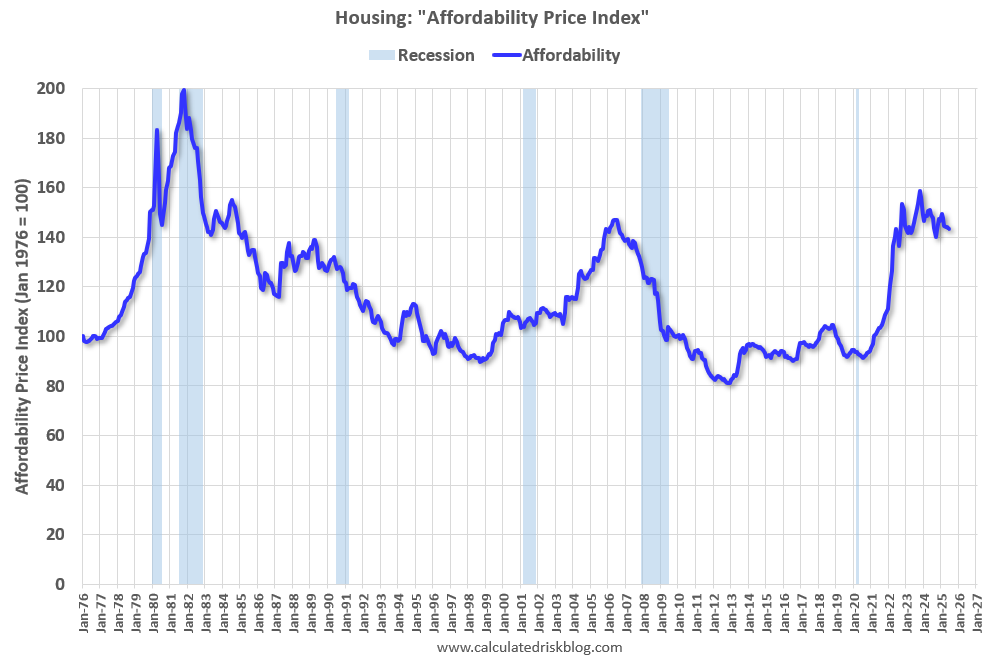

During the pandemic boom, incomes and home prices got way out of sync, and the spike in mortgage rates that followed only widened the gap. What we’re seeing today is a much-needed reset: home prices softening as incomes slowly catch up.

July Housing Data

Median sale price: $999,950 — up 1.1% YoY, but down from June’s $1.048M

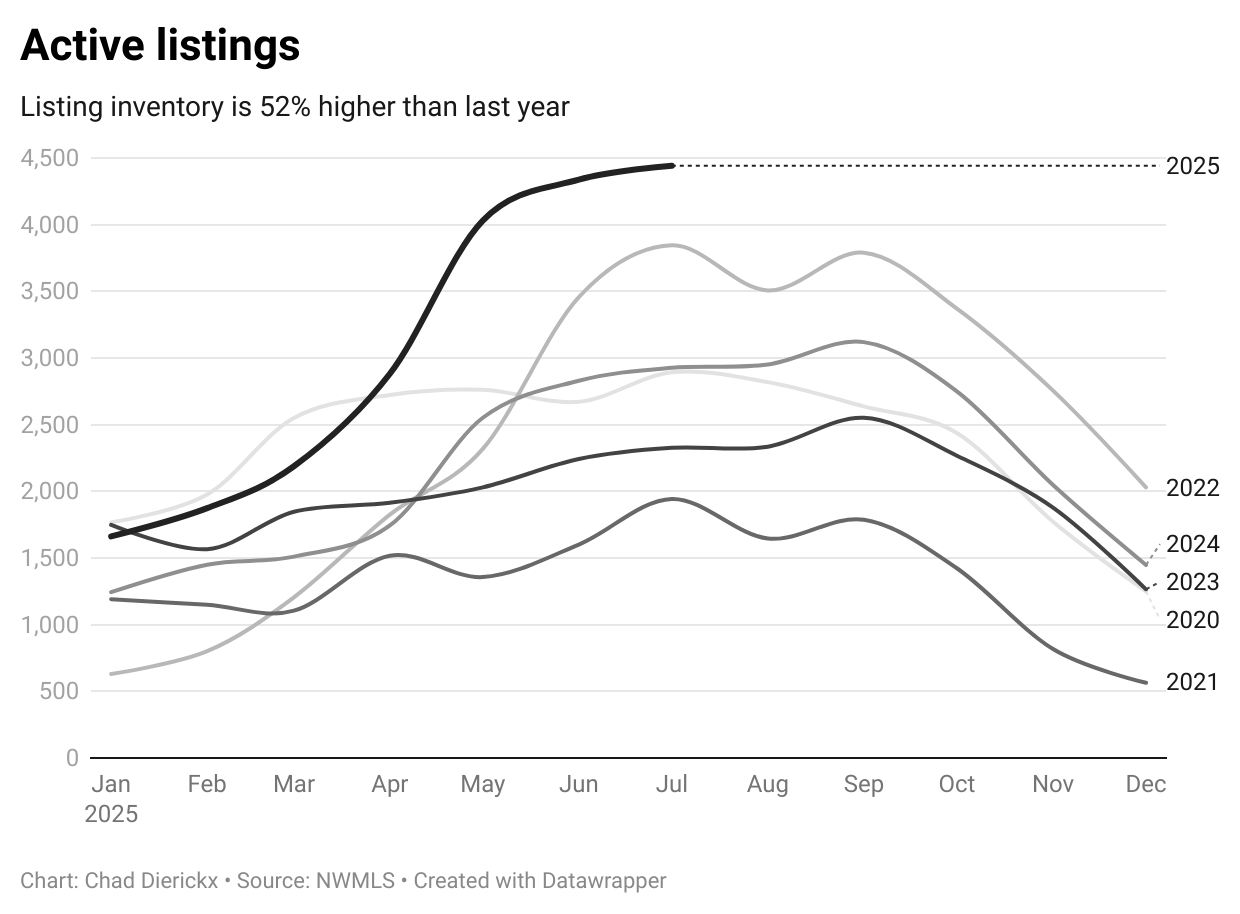

New listings: 2,618 — up 18% YoY, though still fewer than pre-pandemic 2019 levels

Active listings: 4,438 — highest since 2019, up 52% YoY

Pending sales: 1,679 — down month-over-month, but 2% higher than 2024

Closed sales: 1,733 — down 4.4% YoY

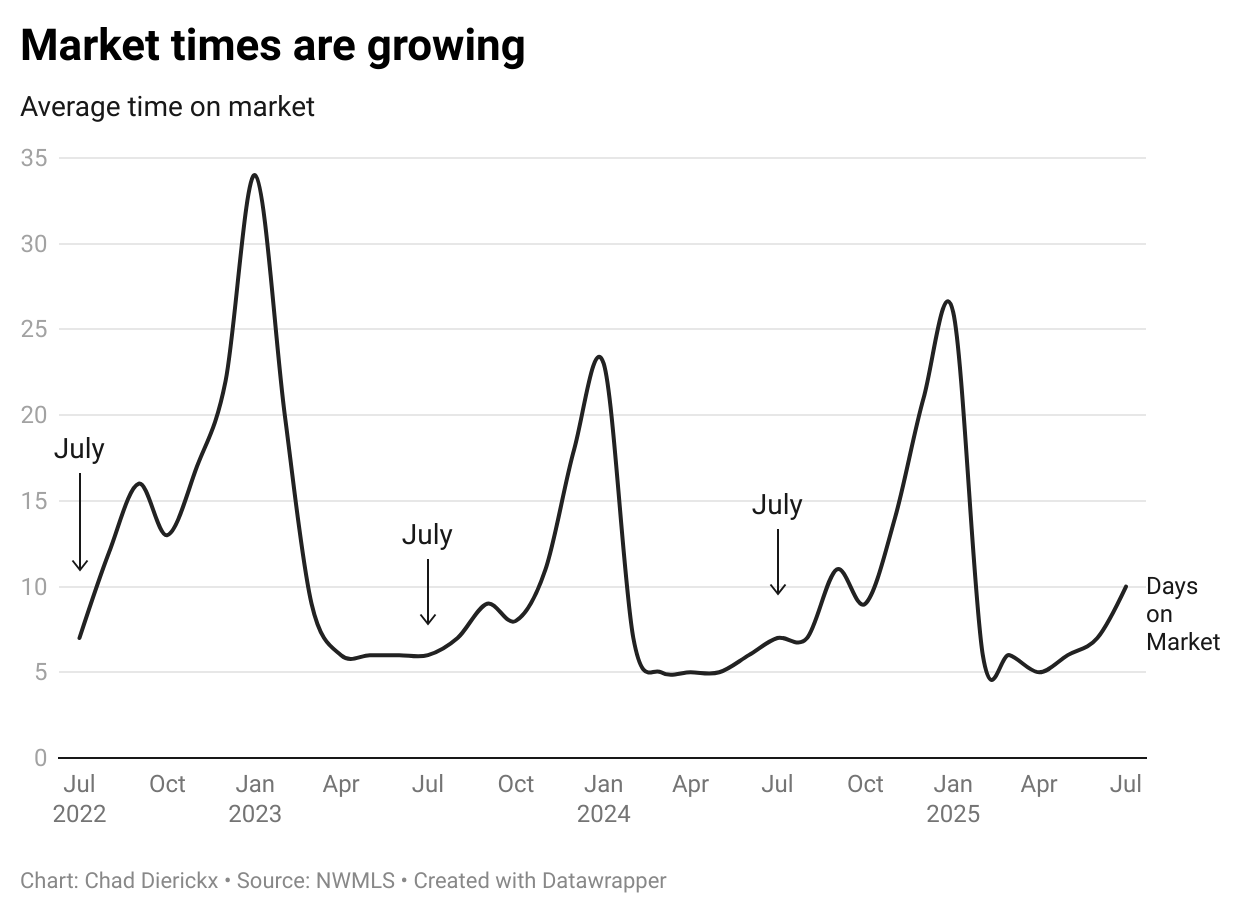

Market speed: Homes averaged 10 days on market (slower than last year, but still brisk)

Months of supply: 3 months — highest level since 2012, giving buyers more breathing room

What it feels like out there

Buyers are finding more negotiability, more options, and a little more time to make decisions. Homes are staying on the market longer partly because of choice, but also because the math is still tough for anyone relying on a mortgage: high prices + high rates + economic uncertainty. That said, well-priced, well-presented homes are still moving quickly, and some are attracting bidding wars even now.

Mortgage rates at their lowest levels all year

Mortgage rates have dipped to their lowest level this year, around 6.5% (Mortgage News Daily). This isn’t because the Fed cut rates (they haven’t), but because bond yields dropped on weak job data and expectations of 1–2 Fed cuts later this year. Still, as long as inflation remains sticky, big rate drops may be hard to come by.

Who’s winning in this market?

If you’re looking long-term, today’s extra supply and calmer pace make for a less stressful search. If you’re holding out for a steep price drop, history suggests you may be waiting a long time — “slow healing” is more likely than “sharp correction.”

Buyers with higher incomes who can stomach current rates are finding friendlier buying conditions, while sellers of single-family homes still see robust demand.

Condos and townhomes, on the other hand, are proving harder to sell. Sometimes, though, even a softer market can be the right moment for an exit.